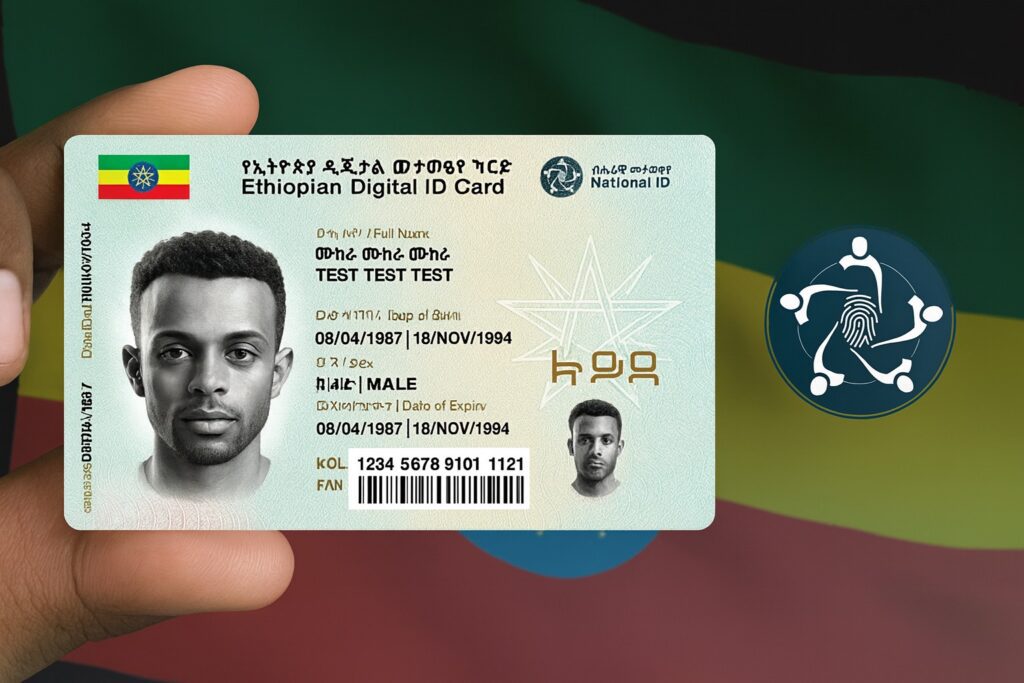

Integration of National ID with Bank Accounts in Ethiopia: A Major Milestone for Digital Transformation

Addis Ababa, December 10, 2025 – The Bank of Ethiopia, in partnership with the Ethiopian National ID Program, has officially launched the integration of the National ID with banking systems. This groundbreaking initiative marks a significant leap towards digital transformation in Ethiopia’s financial sector.

A Leap Towards Enhanced Financial Security

Deputy Governor of the National Bank of Ethiopia, Solomon Desta, described this integration as a pivotal advancement that seeks to reshape the banking landscape. The initiative is designed to promote legal transactions while simultaneously minimizing the risk of fraud and illegal activities. By reinforcing security measures and ensuring compliance with legal frameworks, this initiative strives to build greater trust among banking clients.

Objectives of the National ID Integration

The primary goals of the integration include:

- Promoting Legal Transactions: Establishing a robust system that encourages transparency in financial dealings.

- Curbing Illegal Activities: Implementing measures that help detect and prevent criminal financial behavior.

- Enhancing Security: Utilizing the National ID framework to ensure that banking transactions are safer for all individuals.

Protecting Personal Information

Yodahe Zemichael, Director General of the Ethiopian National ID Program, emphasized the importance of linking citizen data directly to banking platforms. This integration aims to provide a dual layer of security, enhancing consumer protection while ensuring that personal information is safeguarded against potential data breaches.

Understanding the Fayda Number

Moving forward, it will be mandatory for all banks to align customers’ bank accounts with their Fayda number from the National ID system. This unique identifier will serve as a secure reference point for all financial transactions, solidifying the connection between personal identification and banking activities.

Benefits for Citizens and Financial Institutions

The integration of the National ID with bank accounts is set to deliver several benefits:

- Streamlined Banking Processes: Simplifying the onboarding process for new clients.

- Increased Accessibility: Making banking services more accessible to all citizens.

- Improved Fraud Detection: Enhancing the ability to identify fraudulent activities through centralized identification.

In conclusion, the integration of the National ID with banking systems in Ethiopia is a forward-thinking step towards a more secure and efficient financial ecosystem. By promoting legal transactions and tightening security measures, both customers and financial institutions can engage in safer banking practices.

For more information about Ethiopia’s National ID Program, visit the official website.

This initiative not only aims to redefine the financial transactions in Ethiopia but also sets a precedent for other nations considering similar integrations. The future of banking in Ethiopia is poised for transformation, promising increased security and accountability for all citizens.