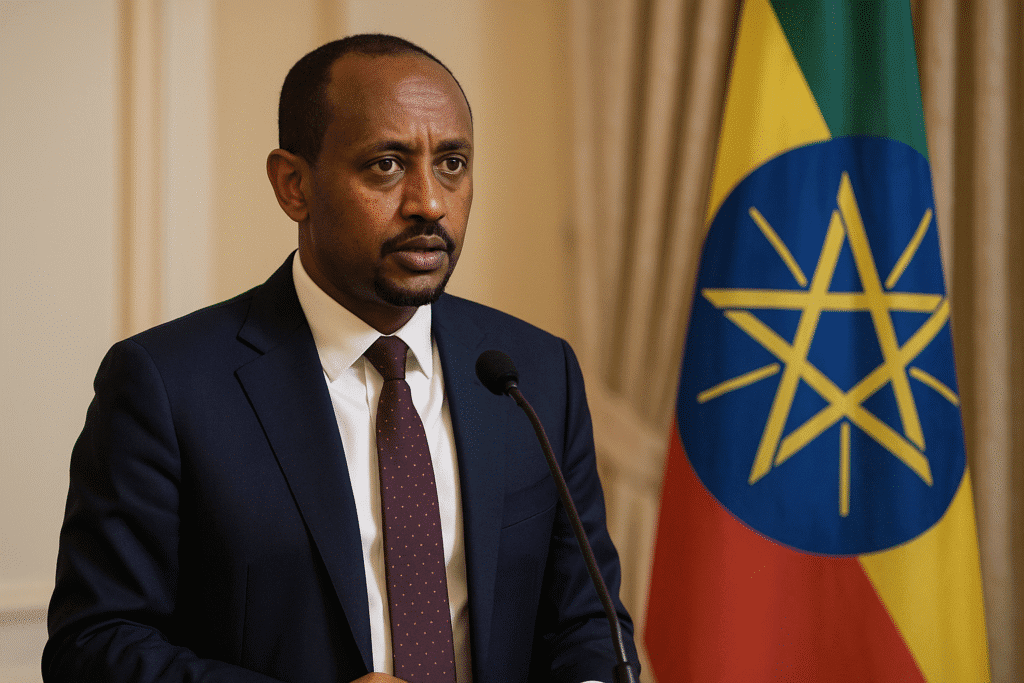

Washington, D.C. – October 20, 2024 – The National Bank of Ethiopia (NBE) Governor Mamo Mihretu, alongside CEOs from several leading Ethiopian banks, gathered at the Ethiopian Embassy in Washington to discuss recent banking reforms and financial restructuring initiatives designed to modernize the nation’s banking sector.

During the event, Governor Mamo addressed concerns from the Ethiopian diaspora regarding the floating exchange rate of the Birr and the significant regulatory changes underway. He noted real progress towards convergence between the parallel exchange rate and the newly established market-based bank exchange rate over the past two months, a natural result of the free exchange rate system.

Concerns about rampant inflation and a drastic depreciation of the Birr have diminished, with the governor asserting, “such a scenario was highly unlikely due to a monetary policy that’s periodically reviewed and adjusted according to market conditions.” He emphasized that measures have been taken to mitigate inflationary pressures and currency depreciation.

The shift to a free-floating currency has bolstered the export sector and increased remittances, with Dashen Bank reporting a staggering 300% year-over-year rise in dollar remittances in its third-quarter report. Despite the increased availability of foreign exchange in the banking sector however, bankers contend that importers have shied away, relying on their customary and informal means to access hard currency. “This could be a case of old habits die hard, but I believe it is more likely to be a problem of being misinformed about recent changes—we as banker certainly need to do more to clear up the confusion, said Abe Sano, CEO of state owned, Commercial Bank of Ethiopia, the country’s largest.

Historically, many people in Ethiopia depended on traditional savings and loans schemes, mostly based on small knit circles of friends and family. Modern banking, although more than 120-year-old in the country, only started to make inroads just in the last few decades. For this reason, many remained unbanked up until very recently. This traditional way of thinking about money and credit is baked into the culture. This means relationships, be they familial or communal are still strong in business. These are not as easy to reform of to modernize. For this reason, a parallel market for foreign currency exchange will likely remain. But the price gap will converge as institutional trust grows. Combined with other incentives provided by licensed financial entities, the legal route for exchanging foreign currency should become more attractive. NBE Governor Mamo reiterated, “our ultimate goal is to instill trust in our banking institutions by building the right incentive mechanism for a healthy financial architecture, one that centers economic development and growth”.

In a bid to enhance transparency and competitiveness, the NBE recently implemented a 2% cap on bank fees for foreign exchange transactions. However, questions linger about potential collusion among major banks in setting similar pricing for dollars and euros, as the price gap between buying and selling rates remains substantial. To further diversify the market, the NBE has licensed five new Independent Foreign Exchange Bureaus, including Dugda Fidelity Investment PLC and Global Independent Foreign Exchange Bureau.

While the Ethiopian banking sector shows signs of recovery, with restructured debt and improved capital adequacy, loan portfolios remain constrained, primarily serving a limited clientele. Governor Mamo pointed to the success of microfinance as a model for broader lending, suggesting that larger banks need to adopt similar strategies to reach a wider public. New fintech players, such as Ethio-Telecom’s TeleBirr, are poised to outpace traditional banks in attracting borrowers.

Ethiopia is also considering the entry of foreign retail banks into its previously closed market, a move that could disrupt the landscape for domestic banks that have historically faced little competition due to stringent regulations. “The layers of strict regulation meant there was little incentive to innovate for banks,” Governor Mamo noted. Dashen Bank’s CEO Asfaw Alemu said “Stringent regulation meant there was little you can do to fail as a bank in Ethiopia—you were always parented by the state”. Indeed, bank failure is very rare in Ethiopia, not because the banks are good, but rather because of moral hazard. The recent reforms aim to reduce bureaucratic obstacles and enhance the overall banking environment, though many local banks may struggle to compete against foreign entrants without adequate capitalization.

Legislation is on the horizon to encourage bank mergers, aiming to centralize capital and strengthen the sector in anticipation of increased competition. Pooling resources will be a matter of survival even for the biggest of the current institutions. As Ethiopia navigates these transformative changes, the future of its banks is poised for historic evolution, one that is long overdue.

The post Ethiopia’s Banking Sector Set for Transformation Amid New Reforms appeared first on Abren.