Ethiopia Advocates for Streamlined Debt Restructuring at Global Sovereign Debt Roundtable

Ethiopia is advocating for a more efficient framework to finalize its debt restructuring amid ongoing discussions at the 2025 Global Sovereign Debt Roundtable, part of the World Bank-IMF Annual Meetings. This push for expediency comes as the country strives to stabilize its economy and improve its financial landscape.

Recent Developments in Ethiopia’s Debt Restructuring

Ethiopia’s Finance Minister Ahmed Shide noted that the nation reached an initial agreement on restructuring terms with its official creditors in March 2025. This significant development was solidified in a Memorandum of Understanding (MoU) drafted in July 2025. The preliminary agreement outlines debt relief measures estimated at around $3.5 billion spanning from 2023 to 2028, aimed at restoring debt sustainability and enhancing Ethiopia’s external debt profile.

Ongoing Negotiations with Creditors

Despite this initial agreement, ongoing bilateral negotiations with individual creditor countries and Eurobond holders are essential to finalize the restructuring. Ethiopia has proposed measures to address its debt obligations; however, bondholders have suggested alternatives, including a “Value Recovery Instrument” linked to the country’s future export performance.

Legal action remains a potential avenue as complexity increases in reaching final agreements, particularly with private creditors. The Finance Minister emphasized the importance of a quick transition from preliminary agreements to finalized contracts to bolster Ethiopia’s financial recovery.

Urgent Call for Efficiency in Debt Treatment

During the Global Sovereign Debt Roundtable, Shide highlighted that despite achieving tangible outcomes through the current framework, the transition to fully executed deals has been sluggish. He urged the establishment of a more streamlined process to convert preliminary terms into finalized agreements. Delays may undermine the effectiveness of international debt treatment mechanisms, further complicating Ethiopia’s financial rehabilitation.

Ethiopia’s Role in the G20 Common Framework

Ethiopia was among the first countries to seek relief under the G20 Common Framework for Debt Treatments, an initiative tailored to assist low-income nations grappling with unsustainable debt. This framework is designed to ensure equitable treatment among all creditors while facilitating debt restructuring. Similar successes have been observed in countries like Zambia and Ghana, which have successfully completed their restructurings with official creditors.

The Global Sovereign Debt Roundtable

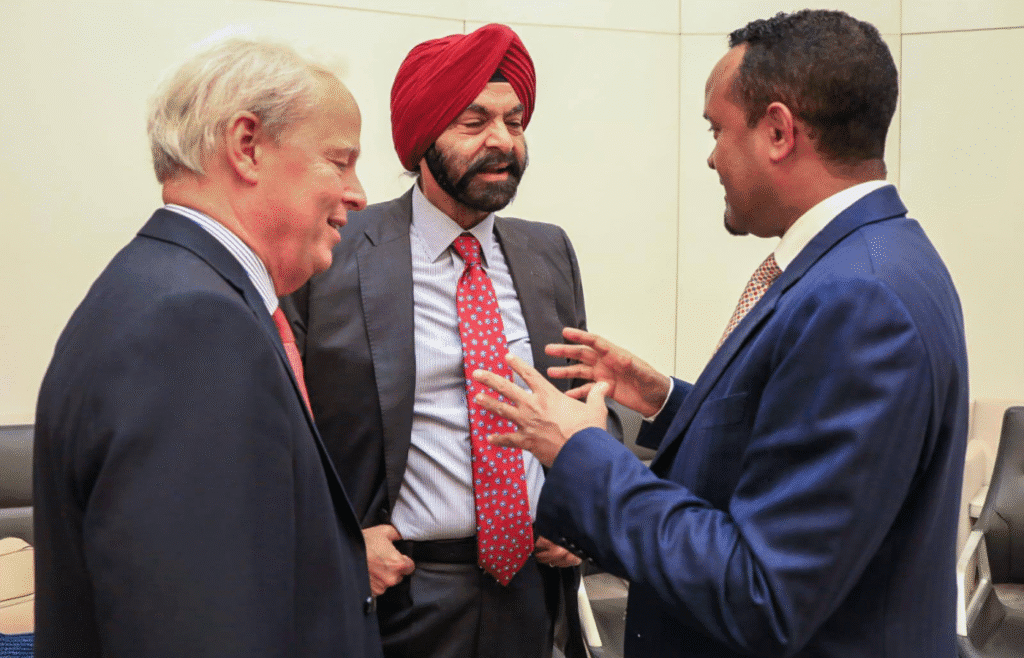

The Roundtable, co-chaired by IMF Managing Director Kristalina Georgieva, World Bank President Ajay Banga and the G20 co-chair South Africa, discussed measures to enhance the efficiency of the G20 Common Framework. The meeting aimed to address the ongoing challenges faced by countries like Ethiopia in securing timely debt relief.

Conclusion

As Ethiopia seeks to restructure its debt efficiently, the ongoing dialogue at the Global Sovereign Debt Roundtable is crucial. The country’s commitment to restoring economic stability and improving its external debt profile underscores the importance of a robust and expedited approach to debt negotiations. By advocating for increased efficiency, Ethiopia hopes to pave the way for a transparent and fair debt resolution process that serves to strengthen its economy and support its future growth.

For further information on debt relief mechanisms and their effectiveness, visit the World Bank’s official page and stay updated on Ethiopia’s economic developments.